Does Tennessee Have A Real Estate Transfer Tax . in the state of tennessee, a transfer tax is collected anytime anything of value is exchanged for the transfer of real. realty transfer tax is imposed on all transfers of real property, with certain exceptions, for having a deed, decree or. Some cities and counties also charge their own transfer taxes. Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing. Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing. So, for a house worth $321,435 — the median home price in the state — the transfer tax due will be $1,189. statewide, tennessee levies a tax of $0.37 per $100 on publicly recorded documents for all realty transfers. tennessee's current transfer tax rate is usually $0.37 per $100. the tennessee state department of revenue controls the tennessee real estate transfer tax rate, which shall be $0.37 per every $100 indebtedness.

from www.pdffiller.com

in the state of tennessee, a transfer tax is collected anytime anything of value is exchanged for the transfer of real. Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing. the tennessee state department of revenue controls the tennessee real estate transfer tax rate, which shall be $0.37 per every $100 indebtedness. statewide, tennessee levies a tax of $0.37 per $100 on publicly recorded documents for all realty transfers. realty transfer tax is imposed on all transfers of real property, with certain exceptions, for having a deed, decree or. tennessee's current transfer tax rate is usually $0.37 per $100. Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing. Some cities and counties also charge their own transfer taxes. So, for a house worth $321,435 — the median home price in the state — the transfer tax due will be $1,189.

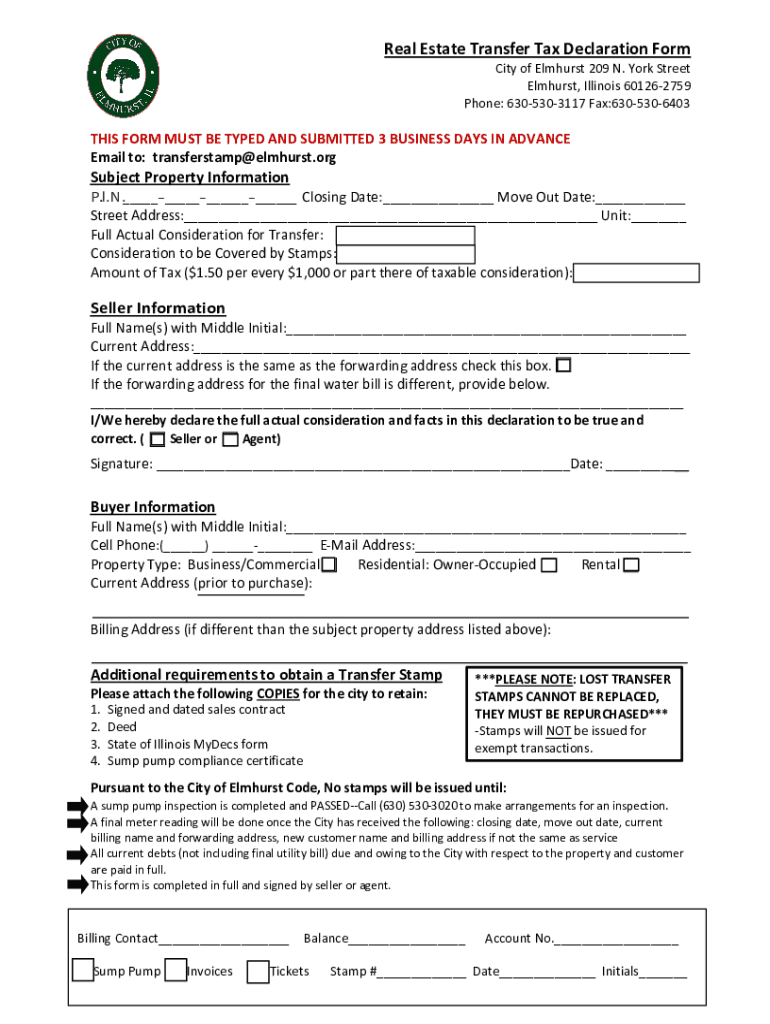

Fillable Online Real Estate Transfer Tax Declaration Form Elmhurst

Does Tennessee Have A Real Estate Transfer Tax Some cities and counties also charge their own transfer taxes. realty transfer tax is imposed on all transfers of real property, with certain exceptions, for having a deed, decree or. Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing. statewide, tennessee levies a tax of $0.37 per $100 on publicly recorded documents for all realty transfers. in the state of tennessee, a transfer tax is collected anytime anything of value is exchanged for the transfer of real. Some cities and counties also charge their own transfer taxes. the tennessee state department of revenue controls the tennessee real estate transfer tax rate, which shall be $0.37 per every $100 indebtedness. So, for a house worth $321,435 — the median home price in the state — the transfer tax due will be $1,189. tennessee's current transfer tax rate is usually $0.37 per $100. Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing.

From templates.legal

Tennessee Deed Forms & Templates (Free) [Word, PDF, ODT] Does Tennessee Have A Real Estate Transfer Tax So, for a house worth $321,435 — the median home price in the state — the transfer tax due will be $1,189. realty transfer tax is imposed on all transfers of real property, with certain exceptions, for having a deed, decree or. Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing. . Does Tennessee Have A Real Estate Transfer Tax.

From help.ltsa.ca

File a Property Transfer Tax Return LTSA Help Does Tennessee Have A Real Estate Transfer Tax tennessee's current transfer tax rate is usually $0.37 per $100. the tennessee state department of revenue controls the tennessee real estate transfer tax rate, which shall be $0.37 per every $100 indebtedness. Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing. in the state of tennessee, a transfer tax is. Does Tennessee Have A Real Estate Transfer Tax.

From dxoluqmio.blob.core.windows.net

Real Estate Transfers Charleston Sc at Michael Hilson blog Does Tennessee Have A Real Estate Transfer Tax tennessee's current transfer tax rate is usually $0.37 per $100. Some cities and counties also charge their own transfer taxes. the tennessee state department of revenue controls the tennessee real estate transfer tax rate, which shall be $0.37 per every $100 indebtedness. So, for a house worth $321,435 — the median home price in the state — the. Does Tennessee Have A Real Estate Transfer Tax.

From www.pdffiller.com

Fillable Online Application for State Real Estate Transfer Tax (SRETT Does Tennessee Have A Real Estate Transfer Tax Some cities and counties also charge their own transfer taxes. Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing. statewide, tennessee levies a tax of $0.37 per $100 on publicly recorded documents for all realty transfers. So, for a house worth $321,435 — the median home price in the state — the. Does Tennessee Have A Real Estate Transfer Tax.

From www.pdffiller.com

Fillable Online Real Estate Transfer Tax Declaration Form Elmhurst Does Tennessee Have A Real Estate Transfer Tax tennessee's current transfer tax rate is usually $0.37 per $100. So, for a house worth $321,435 — the median home price in the state — the transfer tax due will be $1,189. realty transfer tax is imposed on all transfers of real property, with certain exceptions, for having a deed, decree or. Some cities and counties also charge. Does Tennessee Have A Real Estate Transfer Tax.

From www.felixhomes.com

Real Estate Transfer Tax in Tennessee 2024 Cost Estimate & Details Does Tennessee Have A Real Estate Transfer Tax Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing. the tennessee state department of revenue controls the tennessee real estate transfer tax rate, which shall be $0.37 per every $100 indebtedness. tennessee's current transfer tax rate is usually $0.37 per $100. So, for a house worth $321,435 — the median home. Does Tennessee Have A Real Estate Transfer Tax.

From www.theoldfathergroup.com

Real Estate Transfer Tax What Are They & Where Does The Money Go Does Tennessee Have A Real Estate Transfer Tax Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing. tennessee's current transfer tax rate is usually $0.37 per $100. statewide, tennessee levies a tax of $0.37 per $100 on publicly recorded documents for all realty transfers. realty transfer tax is imposed on all transfers of real property, with certain exceptions,. Does Tennessee Have A Real Estate Transfer Tax.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Westchester County? Does Tennessee Have A Real Estate Transfer Tax in the state of tennessee, a transfer tax is collected anytime anything of value is exchanged for the transfer of real. So, for a house worth $321,435 — the median home price in the state — the transfer tax due will be $1,189. Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing.. Does Tennessee Have A Real Estate Transfer Tax.

From www.cbpp.org

State “Mansion Taxes” on Very Expensive Homes Center on Budget and Does Tennessee Have A Real Estate Transfer Tax Some cities and counties also charge their own transfer taxes. Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing. tennessee's current transfer tax rate is usually $0.37 per $100. in the state of tennessee, a transfer tax is collected anytime anything of value is exchanged for the transfer of real. Tennessee. Does Tennessee Have A Real Estate Transfer Tax.

From www.highrockiesliving.com

Real Estate Transfer Tax Summit County Guide High Rockies Does Tennessee Have A Real Estate Transfer Tax So, for a house worth $321,435 — the median home price in the state — the transfer tax due will be $1,189. statewide, tennessee levies a tax of $0.37 per $100 on publicly recorded documents for all realty transfers. Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing. Tennessee imposes a tax. Does Tennessee Have A Real Estate Transfer Tax.

From lukinski.com

Real Estate Transfer Tax Hidden Additional Cost Explained ℄ Real Does Tennessee Have A Real Estate Transfer Tax Some cities and counties also charge their own transfer taxes. tennessee's current transfer tax rate is usually $0.37 per $100. So, for a house worth $321,435 — the median home price in the state — the transfer tax due will be $1,189. realty transfer tax is imposed on all transfers of real property, with certain exceptions, for having. Does Tennessee Have A Real Estate Transfer Tax.

From www.hauseit.com

How Much Is the Real Estate Transfer Tax in Yonkers? Does Tennessee Have A Real Estate Transfer Tax Some cities and counties also charge their own transfer taxes. statewide, tennessee levies a tax of $0.37 per $100 on publicly recorded documents for all realty transfers. realty transfer tax is imposed on all transfers of real property, with certain exceptions, for having a deed, decree or. So, for a house worth $321,435 — the median home price. Does Tennessee Have A Real Estate Transfer Tax.

From listwithclever.com

Tennessee Real Estate Transfer Taxes An InDepth Guide Does Tennessee Have A Real Estate Transfer Tax So, for a house worth $321,435 — the median home price in the state — the transfer tax due will be $1,189. Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing. the tennessee state department of revenue controls the tennessee real estate transfer tax rate, which shall be $0.37 per every $100. Does Tennessee Have A Real Estate Transfer Tax.

From pointacquisitions.com

A Guide To Property Tax Reassessment Point Acquisitions Does Tennessee Have A Real Estate Transfer Tax the tennessee state department of revenue controls the tennessee real estate transfer tax rate, which shall be $0.37 per every $100 indebtedness. Some cities and counties also charge their own transfer taxes. So, for a house worth $321,435 — the median home price in the state — the transfer tax due will be $1,189. Tennessee imposes a tax of. Does Tennessee Have A Real Estate Transfer Tax.

From www.universalpacific1031.com

Real Estate Transfer Tax A Guide for Real Estate Investors (2024 Does Tennessee Have A Real Estate Transfer Tax So, for a house worth $321,435 — the median home price in the state — the transfer tax due will be $1,189. Some cities and counties also charge their own transfer taxes. realty transfer tax is imposed on all transfers of real property, with certain exceptions, for having a deed, decree or. Tennessee imposes a tax of $0.37 per. Does Tennessee Have A Real Estate Transfer Tax.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Westchester County? Does Tennessee Have A Real Estate Transfer Tax statewide, tennessee levies a tax of $0.37 per $100 on publicly recorded documents for all realty transfers. Tennessee imposes a tax of $0.37 per $100 for the privilege of publicly recording documents evidencing. realty transfer tax is imposed on all transfers of real property, with certain exceptions, for having a deed, decree or. tennessee's current transfer tax. Does Tennessee Have A Real Estate Transfer Tax.

From www.formsbirds.com

Real Property Transfer Tax Return Free Download Does Tennessee Have A Real Estate Transfer Tax tennessee's current transfer tax rate is usually $0.37 per $100. in the state of tennessee, a transfer tax is collected anytime anything of value is exchanged for the transfer of real. Some cities and counties also charge their own transfer taxes. So, for a house worth $321,435 — the median home price in the state — the transfer. Does Tennessee Have A Real Estate Transfer Tax.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Los Angeles? Does Tennessee Have A Real Estate Transfer Tax in the state of tennessee, a transfer tax is collected anytime anything of value is exchanged for the transfer of real. So, for a house worth $321,435 — the median home price in the state — the transfer tax due will be $1,189. Some cities and counties also charge their own transfer taxes. tennessee's current transfer tax rate. Does Tennessee Have A Real Estate Transfer Tax.